Understanding the Importance of a Higher Education Funding Strategy

A well-planned higher education funding approach helps you keep away from needless debt while permitting you to focus on academics and personal growth. Rather than relying on a single source of finance, a hybrid education funding technique combines multiple streams — which include grants, financial savings, employer support, and side profits — to create a balanced and flexible plan.

This approach is in especially beneficial for students pursuing sustainable finance executive education or postgraduate programs, where costs may be higher but the return on investment is substantial. By diversifying your investment assets, you may lessen financial threat and gain a sense of monetary independence during your instructional adventure.

What Is a Hybrid Education Funding Strategy?

A hybrid funding approach integrates both conventional and alternative funding options to cover academic expenses. Traditional assets include own family savings, scholar loans, and scholarships, while alternative methods can range from crowdfunding and employer sponsorships to analyze assistantships and on-line income streams.

The purpose is to align your funding mix along with your personal goals, financial capacity, and course requirements. A hybrid version not only offers flexibility but but also facilitates college students adapt to changing financial situations during their research.

Step 1: Assess Your Total Education Costs

Before developing your hybrid strategy, start with a practical estimate of your overall prices. This consists of:

• Tuition costs (annual and program based)

• Accommodation and utilities

• Books, software program, and study materials

• Travel and visa expenses (for international students)

• Daily living and food expenses

• Miscellaneous costs (health insurance, extracurricular activities, etc.)

Having a clear view of your expected expenses will assist you identify the funding gap that needs to be filled. It is the foundation for managing education expenses efficiently.

Step 2: Explore Traditional Funding Options

Traditional investment resources remain the backbone of most higher education investment plans. Some of the most reliable methods include:

1. Personal Savings and Family Contributions

Start by means of evaluating how much you or your family can contribute. This may additionally include personal savings, investment returns, or education-specific funds.

2. Scholarships and Grants

These are the most acceptable styles of funding on the grounds that they don’t require repayment. Look for merit based, need-based, or subject-specific scholarships. International students can explore university-specific awards or government-funded scholarships which include the Fulbright Program, Chevening Scholarships, or Erasmus +.

3. Education Loans

Student loans can bridge big funding gaps. Compare interest rates, compensation alternatives, and loan terms before committing. Consider education loans offered by banks, non-banking financial institutions, or international student loan packages.

4. Work-Study Programs

Many universities offer part-time opportunities that allow students to earn whilst they study. This not only helps with funding higher education but also provides valuable work experience.

Step 3: Incorporate Alternative and Innovative Funding Sources

The modern student has access to more creative and flexible ways to fund education. Combining these with traditional methods creates a true hybrid approach to funding your degree.

1. Crowdfunding Platforms

Websites like GoFundMe, Plumfund, or ScholarMatch allow students to share their stories and raise funds from a global audience. This method works well for students with unique goals or limited access to conventional funding.

2. Employer Sponsorships and Reimbursements

If you’re already employed or pursuing an executive education program, ask your employer about tuition reimbursement schemes or professional development funds. Many organizations are willing to invest in employees who want to upskill, especially in fields like sustainable finance executive education or management.

3. Research Assistantships or Teaching Roles

Graduate students can take on teaching or research assistant roles within their universities. These positions often include stipends or tuition waivers, providing both academic and financial benefits.

4. Online and Freelance Work

With digital skills in demand, students can explore remote jobs in writing, design, data entry, or tutoring. Even small streams of income can contribute significantly to managing education expenses.

Step 4: Develop a Balanced Funding Mix

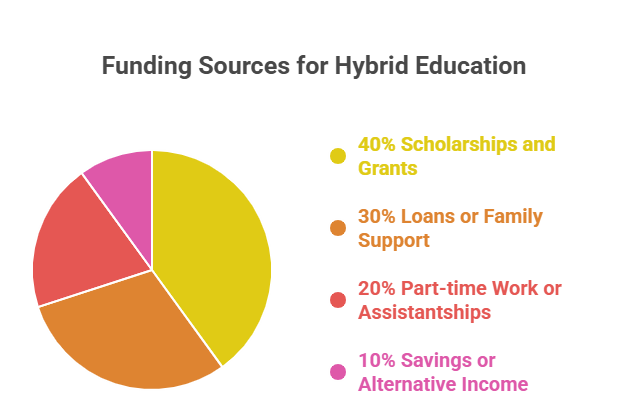

A successful education investment approach must balance risk, accessibility, and sustainability. Here’s how you could structure it:

• 40% Scholarships and Grants – Non-repayable funding paperwork the foundation of your hybrid version.

• 30% Loans or Family Support – Helps cover large expenses which includes tuition and housing.

• 20% Part-time Work or Assistantships – Contributes to living expenses and personal spending.

• 10% Savings or Alternative Income – Acts as a cushion for emergencies or additional needs.

Adjust these ratios based for your personal situation of affairs, country of study, and access to financial resources.

Step 5: Manage and Monitor Your Finances

Creating an investment approach is only half the process — maintaining it calls for continuous tracking. Use budgeting tools like Mint, YNAB, or Google Sheets to track expenses, savings, and debt re payment.

Set short-term and long-term economic desires for each academic years. This discipline will assist you stay on top of the investment requirements while avoiding unnecessary pressure.

Additionally, consider building a small emergency fund to address unexpected expenses such as medical costs or travel emergencies.

Step 6: Seek Expert Financial Advice

Consult financial aid officials, education counselors, or funding advisors before making primary economic selections. Their expertise assist you to apprehend complicated loan terms, discover hidden scholarship opportunities, and plan your reimbursement strategy successfully.

Some universities even offer free financial literacy workshops — take benefit of those to reinforce your training funding strategy.

Conclusion: Smart Planning Leads to Sustainable Success

Creating a personal hybrid funding strategy for higher education is not always just about finding the money for education — it is approximately building a sustainable monetary plan that empowers your educational journey. By combining conventional and progressive funding sources, you may reduce dependence on loans, keep away from last-minute monetary pressure, and focus on what truly matters — your learning and career boom.

Whether you are a recent high school graduate, a mid-career professional pursuing sustainable finance executive education, or an international student looking for education funding ideas, the key is smart planning. The earlier you start designing your hybrid version, the more confident and financially secure your better education experience might be.