"How will we afford this?" One of the first problems that most Indian families have at hand when their child gets into a university abroad is the question of costs. The excitement of an acceptance letter is quickly followed by worry, mostly about tuition fees, rent, daily expenses, and what happens if the money runs out mid-way.

The truth is that only a few students depend on one single source of funding. Most mix and match. Scholarships, part-time work, and oftentimes, loans are combined to meet the costs. This guide explains how to do exactly that.

1. Start with what you do not have to pay back: scholarships and grants

“Look for free money first,” say education counsellors around the world. Scholarships and grants work the best as you do not need to repay. Universities, governments, private foundations, and even religious and community groups offer various types of scholarships and grants. Some consider academic scores, some others consider your financial need, while a few cater to students from specific backgrounds or regions.

One student from Delhi shared, “My university in Canada gave me a merit-based scholarship of CAD 7,000 per year. It covered almost half my tuition.”

How to find scholarships?:

- Visit university websites and check the 'international students' section.

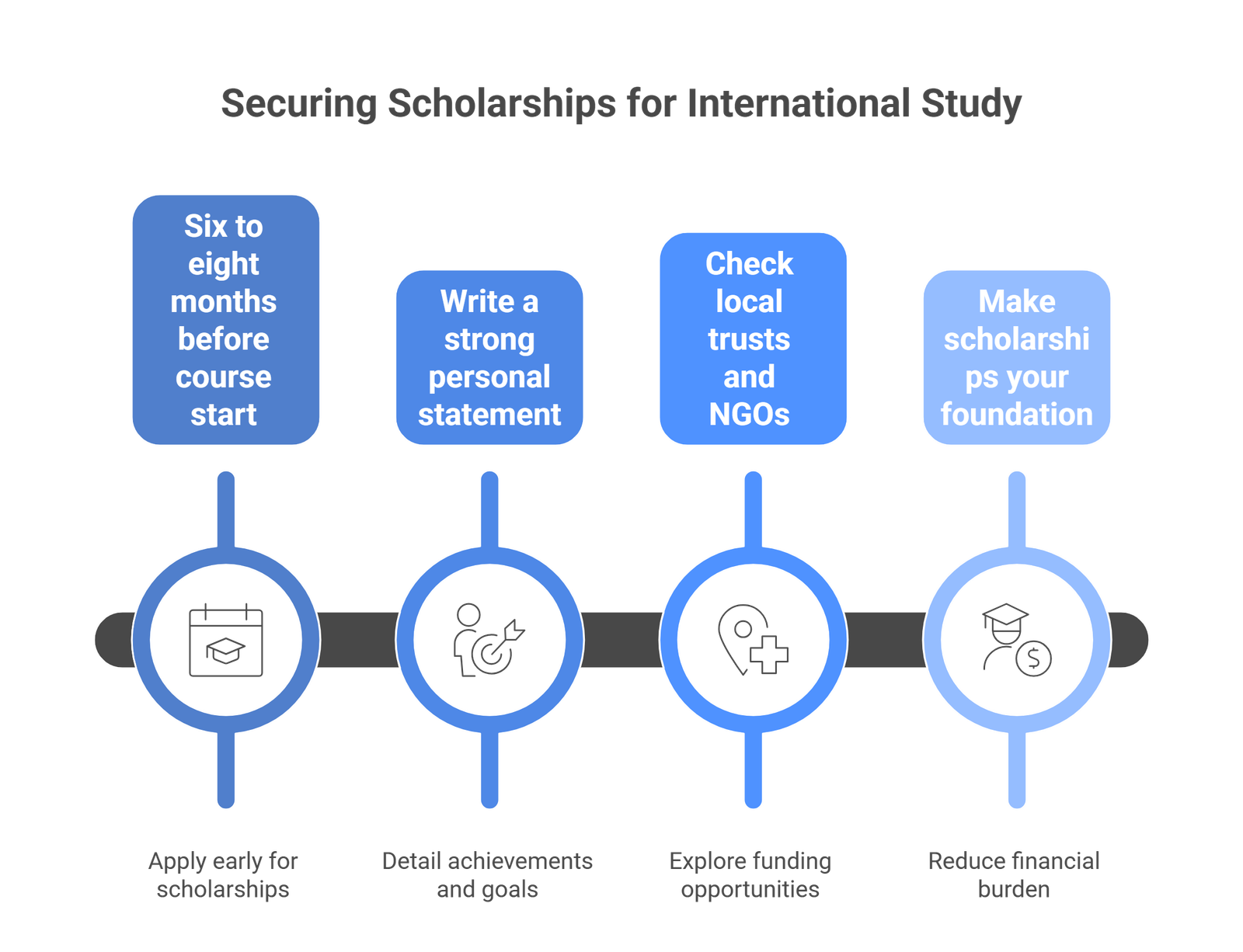

- Apply early as many deadlines close six to eight months before the course starts.

Write a strong personal statement. Give a detailed account of achievements, goals, and reasons for choosing the course. - Check local trusts or NGOs that fund Indian students. For example, Inlaks, JN Tata Endowment, and KC Mahindra Trust offer overseas study grants.

- Make scholarships your foundation. The more you receive, the less you need to work or borrow.

2. Earn while you learn: the power of part-time work

“Working part-time helped me pay my rent and made me more independent,” said Sneha, a student in Australia.

Many countries allow international students to take up part-time jobs while studying. For example:

- In the UK, you can work up to 20 hours per week during classes.

- In Canada, students can work on campus or off campus.

- In Australia, your student visa allows part-time work with flexible rules.

You can find jobs in places like college libraries, cafés, call centres, or even work online. Some students tutor school children. Others help professors with research work. But do not work too much. Try to keep your job between 10 to 15 hours a week. That way, you can earn some money without affecting your studies. Most employers abroad understand student needs and will adjust your work hours if you talk to them clearly. Part-time jobs also help you learn time management, handle money better, and gain work experience that adds value to your resume.

3. If there is still a gap: How to Assess Your Needs and Affordability

“Do I need a loan? How much should I take?” These are important questions every student must ask.

You should think about a loan only after you have checked scholarships and part-time work options. Loans are helpful, but unlike scholarships, you have to repay them—with interest.

In India, many banks give education loans for studying abroad. Public banks like SBI, and private ones like HDFC Credila and Axis Bank, offer different plans. Before choosing, check:

- Interest rate (usually between 8% to 13%)

- Moratorium period (when you need to start repayment—usually 6 to 12 months after finishing the course)

Whether you need to give collateral - What all is covered—like tuition fees, living expenses, and travel costs

- Some students also take loans from foreign lenders like Prodigy Finance or MPower Financing. These usually do not need collateral but might have higher interest rates.

What are the Key Considerations Before Borrowing

- First calculate how much money you are short of, after adding scholarships and expected earnings.

- Talk to your parents about who will repay and how.

- Do not take more loan than you actually need.

As one student shared, “I borrowed only for the first year, then managed the rest through internships and part-time jobs.”

4. Put it all together: a year-by-year plan

Each student’s situation is different. But the order to plan your finances stays the same: use scholarships first, earn from part-time work next, and take a loan only if needed.

Follow this easy 5-step plan every year:

- Calculate your full cost – Add tuition, rent, food, books, travel, health insurance, and a little extra for emergencies.

- Apply for scholarships – Try multiple sources and remember to check deadlines.

- Find work opportunities – Know what kind of jobs your student visa allows and how many hours you can work.

- Take a loan only if required – Borrow based on what is missing after scholarships and work income.

- Review your plan yearly – Things can change. You may get new scholarships or reduce your expenses. Update your plan as needed.

By planning this way, you will avoid stress and keep your finances under control.

5. Common challenges in obtaining a loan and how to handle them

Securing a loan can present several common challenges, which can be overcome with careful preparation and a strong financial profile. While studying abroad, you may face a few difficulties. Here are some common ones and how to deal with them:

- Time pressure: “I was working 25 hours a week and my grades dropped,” said Raj, who later reduced his work hours. Always keep your studies as your main focus.

- Limited work options: Some courses like medicine or law have tight schedules. In such cases, plan your budget more carefully.

- One-time scholarships: Some scholarships are only for the first year. Always read the terms before depending on them.

- Currency changes: The Indian rupee can lose value against foreign currencies. Try to keep a small emergency fund.

If you are unsure, speak to your university’s financial aid office. They can help you with part-time job options, new funding opportunities, and explain how your income may affect other aid. Don't be misguided. Read more on “5 Misconceptions About Higher Education Grants & What You Need to Know!”

6. For Parents: Supporting without overstretching

Parents usually take on both the emotional and financial responsibility when a child plans to study abroad. To manage it well:

- Be honest about what the family can afford – Talk openly about limits and plan together.

- Let your child share the load – Encourage them to work part-time or do internships to cover some expenses.

- Understand the loan details – If you are co-signing a loan, know how and when the repayment will start.

- Think long term – Many students from good foreign universities get jobs within a year or two, and can repay their loans in 5–7 years.

With the right balance of support and planning, your child’s education abroad can be a smart investment, not a financial burden.

Final words: Build a balanced mix

There is no one fixed way to pay for studying abroad. But if you combine scholarships, part-time work, and loans wisely, your dream can become possible.

Ask yourself:

- What is the minimum loan I need to manage my costs?

- How can I earn without affecting my studies?

- Which scholarships match my background and course?

- Plan early. Review your plan every year. With the right balance, studying abroad is not only for the rich. It is for any student who plans well and takes charge of their future.

“First, free money. Then, earned money. Then, borrowed money—only if required.” Let this be your mantra. It truly works.

Further reading and sources

- U.S. Department of Education – Types of Financial Aid: Grants, Work Study, and Loans, StudentAid.gov

- Laura W. Perna – Recognizing the Reality of Working College Students, AAUP.org

- Iowa Student Loan – How Working Can Help Your College Student, iowastudentloan.org

- Fastweb – How Part-Time Jobs Affect Financial Aid, fastweb.com

- College Raptor – How Financial Aid and Work Study Affect Each Other, collegeraptor.com

- Scholarship America – The Busy Student’s Guide to Balancing Work and College, scholarshipamerica.org

- Research.com – Grants, Scholarships & Loans: What’s the Difference for 2025, research.com

- Raj, V. – Student Debt and Behavioural Bias: A Trillion Dollar Problem, arXiv.org